* Commerce purchases resulted from an email campaign

The Challenge

With the Covid-19 pandemic in full swing in 2020, Electrolux’s regional teams in the APAC and MEA regions decided to revive existing email marketing programs and establish new ones in growing markets. The customer envisioned regular newsletter campaigns for all its regional brands as well as a post-purchase onboarding workflow that would automatically provide buyers with relevant information on their products as well as present opportunities for upselling other products.

Going further, Niteco and Electrolux also decided to focus on additional automation for email campaigns across APAC and MEA markets, targeting maximum engagement with customers and potential buyers with minimum effort, freeing up time for Electrolux’s marketing teams.

The Solution

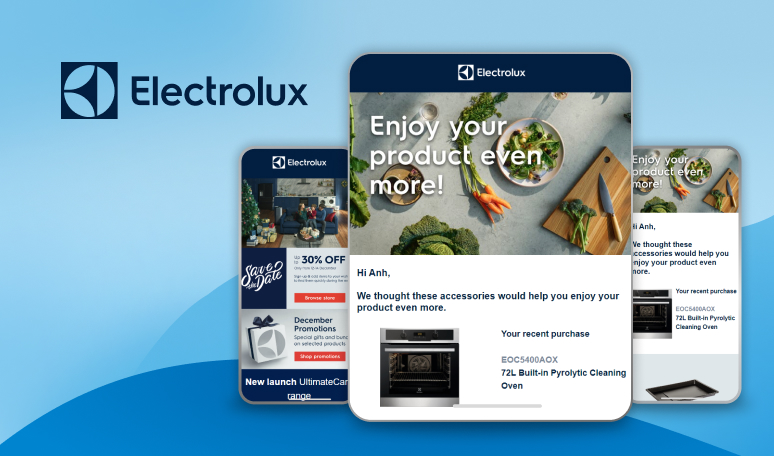

Electrolux’s teams and Niteco’s designers and email marketing team worked closely together to set up a range of EDM templates for various use cases, both pre- and post-purchase. These were first rolled out for Australia in the first half of 2021.

The partners organized regular monthly EDM campaigns for the Electrolux, AEG and Westinghouse brands as well as sends for other Electrolux Group brands. Throughout the year and going into 2022, Niteco’s team, in close cooperation with the customer’s regional teams, also established automated post-purchase and newsletter subscription workflows for these brands in some initial markets that would provide immediate engagement with buyers and potential buyers. With the aim of automating more engagement opportunities, we also set up abandoned cart and accessory purchase campaigns for markets in the APAC region that would automatically target users that had failed to finalize a purchase or had just purchased an appliance a few weeks prior.

Throughout the process, Niteco’s team ensured its availability and flexibility, enabling one-off sends and additional campaigns across markets. Regular collaborative meetings between both partners yielded ideas for new campaigns as well as for A/B tests, which we performed with every single send, allowing the team to gain more insights into its customers.

The Result

The team’s work resulted in impressive increases in key EDM metrics across all brands and markets.

For instance, the average open rate for Electrolux-branded EDMs increased by a whopping 147% from 2020 to 2022, with the open rate for Westinghouse-branded sends jumping by 69% in the same timeframe. From 2021 to 2022, the average open rate for AEG-branded EDMs also increased by 47%.

Average clickthrough rates also climbed steadily across brands: Electrolux saw a 104% increase in the average CTR from 2020 to 2022, while the CTR for Westinghouse rose by 53%.

The three main brands Electrolux, AEG, and Westinghouse saw strong average CTRs for 2022 of 2.93%, 3.86%, and 4.37%, respectively.

The newsletter campaigns also greatly increased the traffic to articles and recipes on the brand sites, with some pages that had previously seen virtually no traffic suddenly receiving hundreds and thousands of visitors, accounting for more than 90% of traffic to those pages.

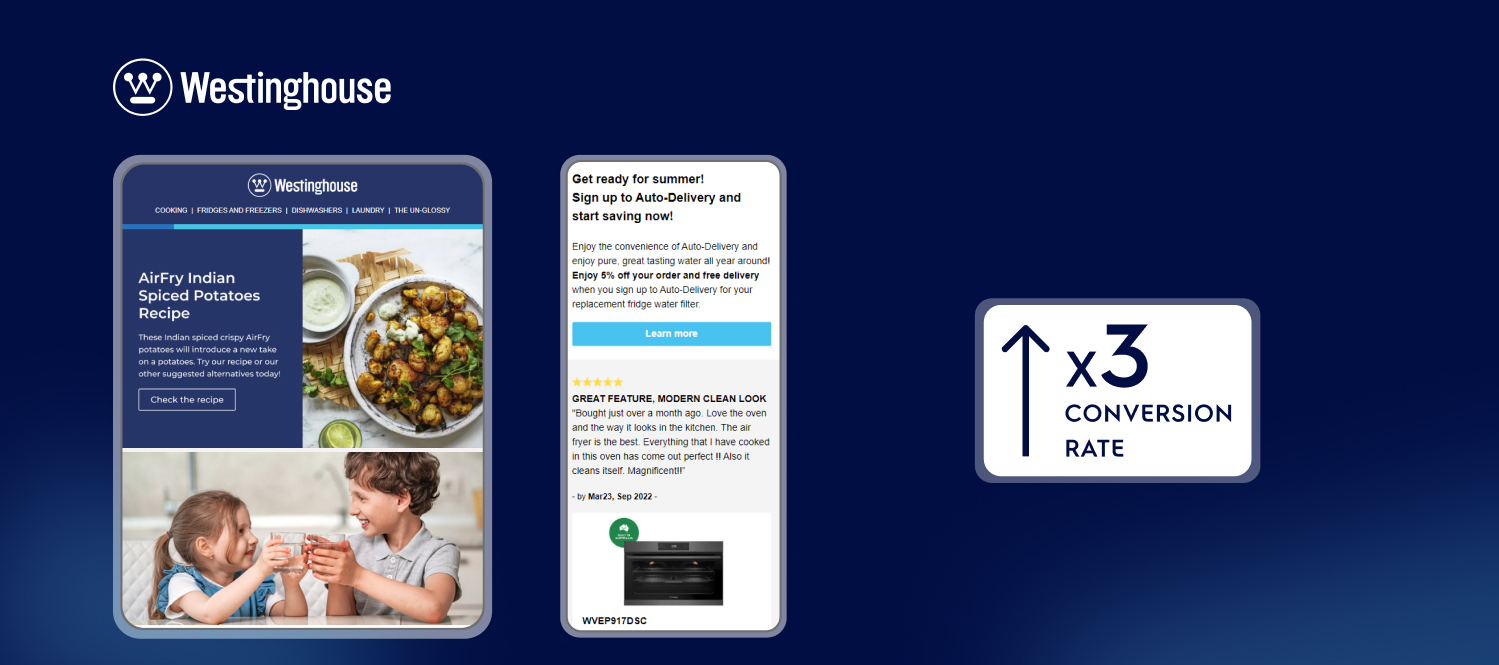

Not only did the traffic increase in quantity, users coming to the brand sites from these EDMs also showed much higher conversion rates than other users. While traffic from emails to a certain Westinghouse oven after an EDM send in February 2022 only accounted for less than one quarter of total traffic to that page, the conversion rate was three times higher than the rate for direct or organic traffic. Other campaigns also saw conversion rates for traffic from email up to twice as high as rates for other traffic.

The team’s efforts to further increase conversions pre- and post-purchase with automated sends also bore fruit, with abandoned cart reminder emails reaching healthy engagement rates. In the Vietnam market, for instance, the sends reached open rates upward of 50% and clickthrough rates of more than 13%. Automated campaigns aimed at recommending consumables and accessories to customers that had recently purchased appliances have also been set up in several APAC markets, creating further opportunities for conversions without added effort for Electrolux’s marketers.

Due to the success of the pre- and post-purchase EDM programs in Australia and New Zealand, Niteco and Electrolux’s cooperation expanded to other APAC markets like Japan, Korea and Vietnam as well as several markets in the MEA region like Egypt and the UAE.